how to pay indiana state estimated taxes online

Wheres My Income Tax Refund. Make an Individual or Small Business Income Payment.

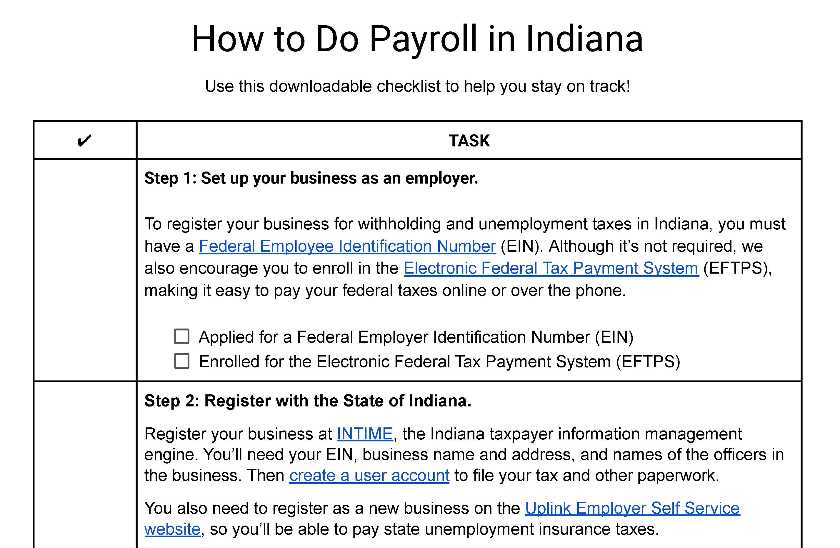

How To Do Payroll In Indiana What Every Employer Needs To Know

June 5 2019 250 PM.

. Tax Payment Solution TPS - Register for EFT payments. Wisconsin Department of Revenue. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Completing Form ES-40 and. Select the Make a Payment link under the.

To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET. Income Adjustment Review Unit. For estimated tax purposes the year is divided into four payment periods.

If you have an MyTax Illinois account click here and log in. Estimated payments may also be made online through Indianas INTIME website. How To Pay Your Taxes With A Credit Card In 2022.

If the amount on line I also includes estimated county tax enter the portion on. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was. We last updated the Estimated.

Property TaxRent Rebate Status. Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. Personal Income Tax Payment.

Access INTIME at intimedoringov. To make an individual estimated tax payment electronically without logging in to INTIME. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

The tax bill is a penalty for not making proper estimated tax payments. When you filed your state return TT would have told you the various options as follows. When To Pay Estimated Taxes.

Since Indiana has a flat tax rate of 323 for 2022 borrowers can multiply that percentage by either 10000 or 20000 for an estimated 323 or 646 of state tax liability a. Line 26 Amount Due Payment OptionsThere are several ways to pay the amount you. If the amount on line I also includes estimated county tax enter the portion on.

You do not need to. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Vehicle use tax bills RUT series tax forms must be paid by check. Individual Payment Type options include. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

DOR Tax Forms Online access to download and print DOR tax. Corporations generally use Form 1120-W to figure estimated tax.

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Indiana Dept Of Revenue Inrevenue Twitter

How To Register For A Sales Tax Permit In Indiana Taxvalet

Dor Owe State Taxes Here Are Your Payment Options

Pin On Printable Business Form Template

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon

Dor Keep An Eye Out For Estimated Tax Payments

Dor Owe State Taxes Here Are Your Payment Options

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Indiana Sales Tax Small Business Guide Truic

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Prepare Efile Your Indiana State Tax Return For 2021 In 2022